Wealth Management - The Facts

Wiki Article

Things about Wealth Management

Table of ContentsLittle Known Questions About Wealth Management.7 Easy Facts About Wealth Management ExplainedWealth Management for BeginnersAbout Wealth ManagementThe 5-Minute Rule for Wealth ManagementGetting My Wealth Management To Work

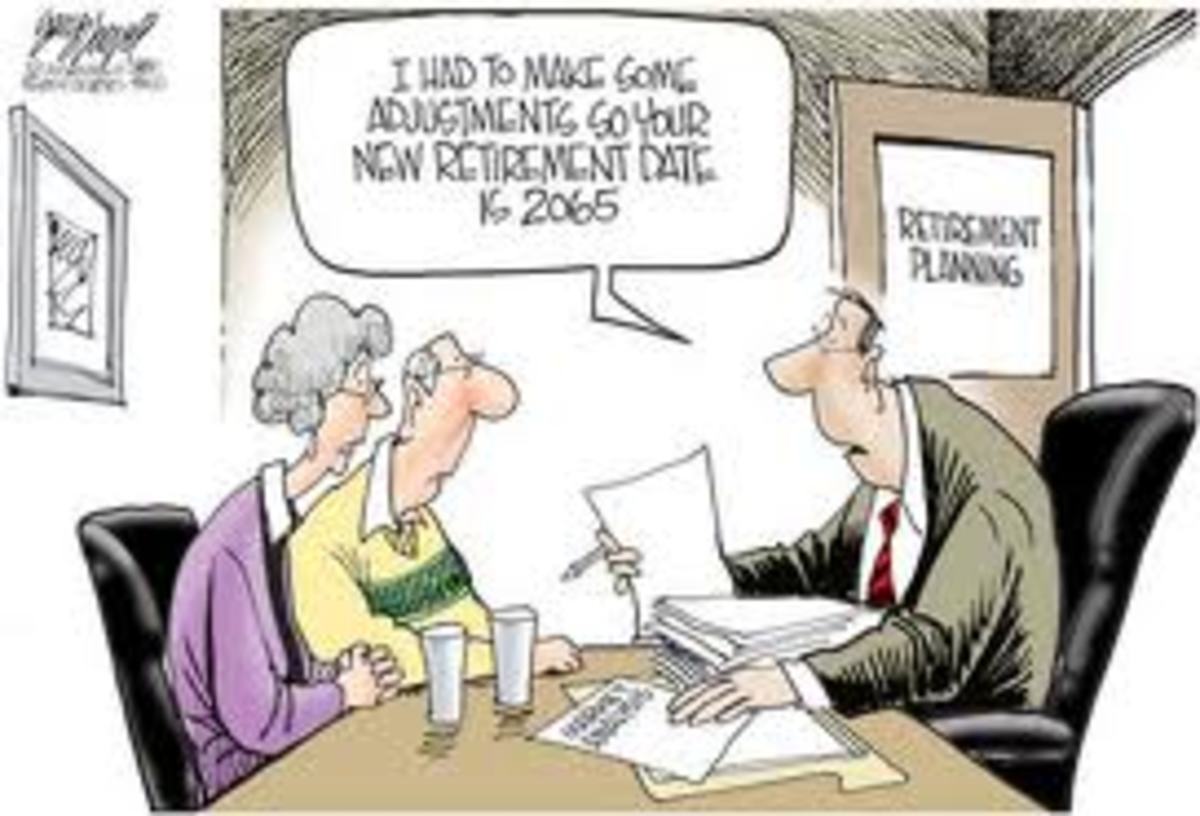

Sadly, several do not have access to an employer-sponsored retirement, such as a 401( k) strategy. Also if your employer does not supply a retirement, you can still save for retired life, by putting money in an Individual Retirement Account (INDIVIDUAL RETIREMENT ACCOUNT). Slow as well as constant success this race.While your retired life might appear a long method off, you owe it to yourself to look toward the future as well as begin assuming concerning what you can do today to aid make certain a secure retirement tomorrow. Time might be on your side, if you ask some of the senior citizens you recognize, they will most likely inform you that conserving for retired life is not as basic as it at first appears.

Numerous people do not realize the potentially serious results of inflation. At 35 years, this quantity would be more lowered to just $34. Hence, it is important to look for retired life savings vehicles that have the finest chance of exceeding rising cost of living.

Little Known Facts About Wealth Management.

The earlier you identify the effects that economic pressures can carry your retired life earnings, the extra likely you will be to embrace strategies that can assist you achieve your long-term goals - wealth management. Being aggressive today can help boost your retired life savings for tomorrow.If preparing for retirement feels like it could be plain or difficult, think again It's your possibility to consider your objectives for the future as well as form a new life survived your terms. Taking a little of time today to think of your life in the future can make all the distinction to your retired life.

A retired life strategy aids you obtain clear on your objectives for the future, such as exactly how you will invest your time, where will certainly you live and also whether your partner really feels the exact same. Recognizing when you plan to retire makes it easier to prepare. Some things to consider include the age you can retire, tax end results and earnings requirements.

The Buzz on Wealth Management

Retired people and also pre-retirees encounter some unique threats when it comes to their investments.

A retirement will certainly discover your options including incomes from part-time job, financial investment earnings, the Age Pension plan and also very financial savings. Dealing with a seasoned retirement coordinator can assist provide economic safety and assurance. It can provide you confidence that you get on track to be able to do the points you want in retirement.

Here's why you need to begin preparing early as opposed to when it's also late. Retired life takes you to a brand-new stage of your life wherein you can genuinely make time for on your own and delight in tasks that you have actually not been able to take note of during your job life.

Wealth Management - Truths

Investing in a retired life plan is essential to ensure this same criterion of living post-retirement. That will aid you with a consistent income every month also after retiring.

This implies that a person will need to pay more for all costs in the future. Hence, while executing important retired life planning, you can consider this component as well as create an adequate retired life fund for your future to live a peaceful life. After your retired life, you shouldn't depend upon anyone, particularly your loved ones.

The Facts About Wealth Management Revealed

Yet, with all these benefits as well as more, you can not refute visit this site right here the fact that this is undoubtedly a terrific investment possibility to surrender on. That's appropriate beginning today!. Now that you have recognized the importance of retirement preparation, you can begin by improving your smart retirement today.

Preparation for retired life is a way to help you preserve the exact same lifestyle in the future. You might not wish to work permanently, or have the ability to totally depend on Social Safety and security. Retirement preparation has 5 actions: recognizing when to start, calculating how much cash you'll require, establishing top priorities, picking accounts and also choosing investments.

The Definitive Guide for Wealth Management

When you can retire boils down to when you intend to retire and when you'll have adequate cash saved to change the income you receive from functioning. The earliest you can begin declaring Social Protection benefits is age 62. By submitting early, you'll give up a part of your advantages.

And also your benefit will really enhance if you can postpone it even more, up until age 70. Some people retire early (since they desire or need to), and many retire later (once again, since they desire or need to). Lots of people find it's best to slowly ease of the workforce instead of retire suddenly.

When should you see this site start retired life planning? Even if you haven't so much as thought about retired life, every dollar you can conserve currently will certainly be much valued later on.

Report this wiki page